We shape the future

Additional Services

Beyond core cover, we offer consultancy, policy reviews, and support to optimise benefits and savings across your insurance portfolio.

Insurance Consultancy

Personalised advice to balance coverage, excesses, and cost. We compare multiple carriers and identify relevant discounts.

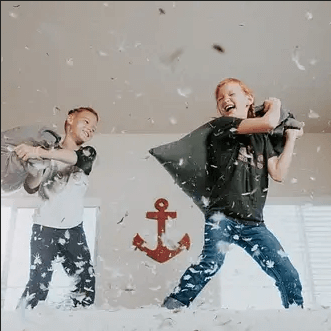

Family Protection Plans

Design a plan for your household—combine home, motor, health, and child protection to streamline cover and save.